Entering a Del tax bill into POSTS R using another Delinquent tax software.

This is used when a county has our accounting software but does not have our delinquent tax software.

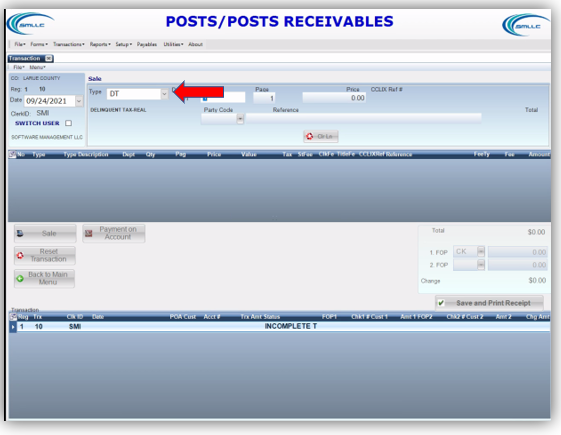

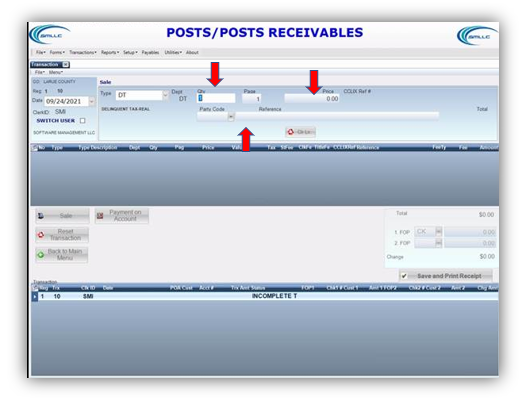

1. After putting POSTS R into Sale mode, you can use codes DT or DT100.

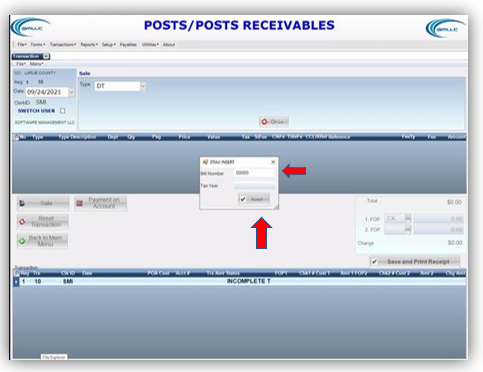

2. Place any amount in the bill number section of the popup and leave the year blank. Click ‘Insert’.

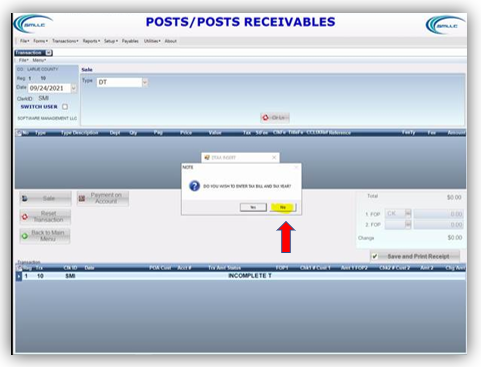

3. POSTS R will ask ‘Do you wish to enter Tax Bill and Tax year?’ click ‘No’.

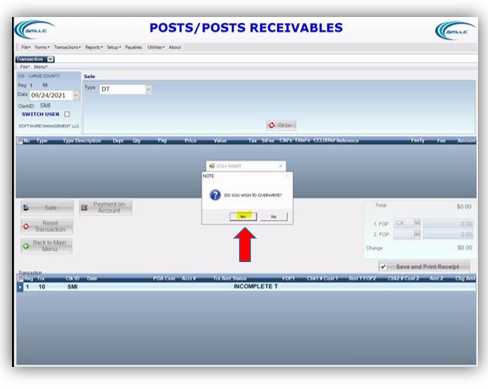

4. The next prompt will say ‘Do you wish to overwrite?’ Click ‘Yes’.

5. Enter in the bill quantity, price and reference and the Transaction is complete.

Comments

0 comments

Please sign in to leave a comment.